Senior Freeze Exemption For Tax Year 2025 Application

Senior Freeze Exemption For Tax Year 2025 Application. Other exemptions, like the “senior freeze” for elderly residents making under $65,000 each year, must be renewed every year. Income from all household members needs to be itemized.

Assessment freeze homestead exemption for 2025. Income from all household members needs to be itemized.

The senior freeze exemption provides tax relief to eligible homeowners who meet age and income requirements (see below) and whose homes have.

Department of the Treasury Senior Freeze 2025 Toolkit, Be a senior citizen with an annual household income of $65,000 or less. Income from all household members needs to be itemized.

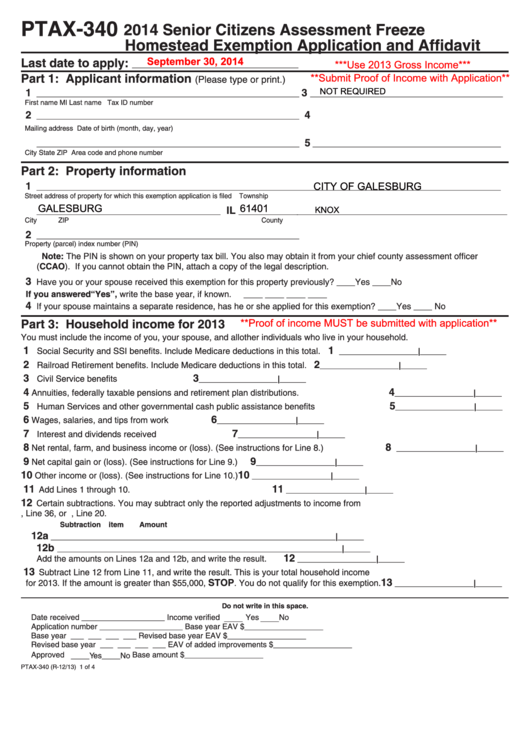

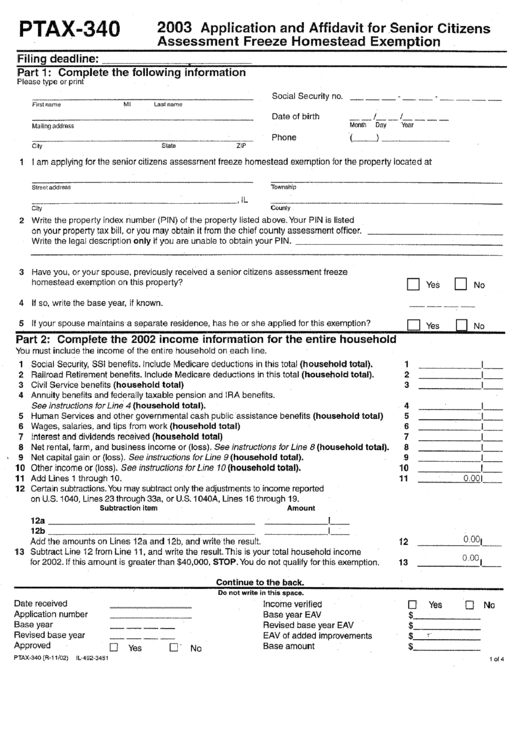

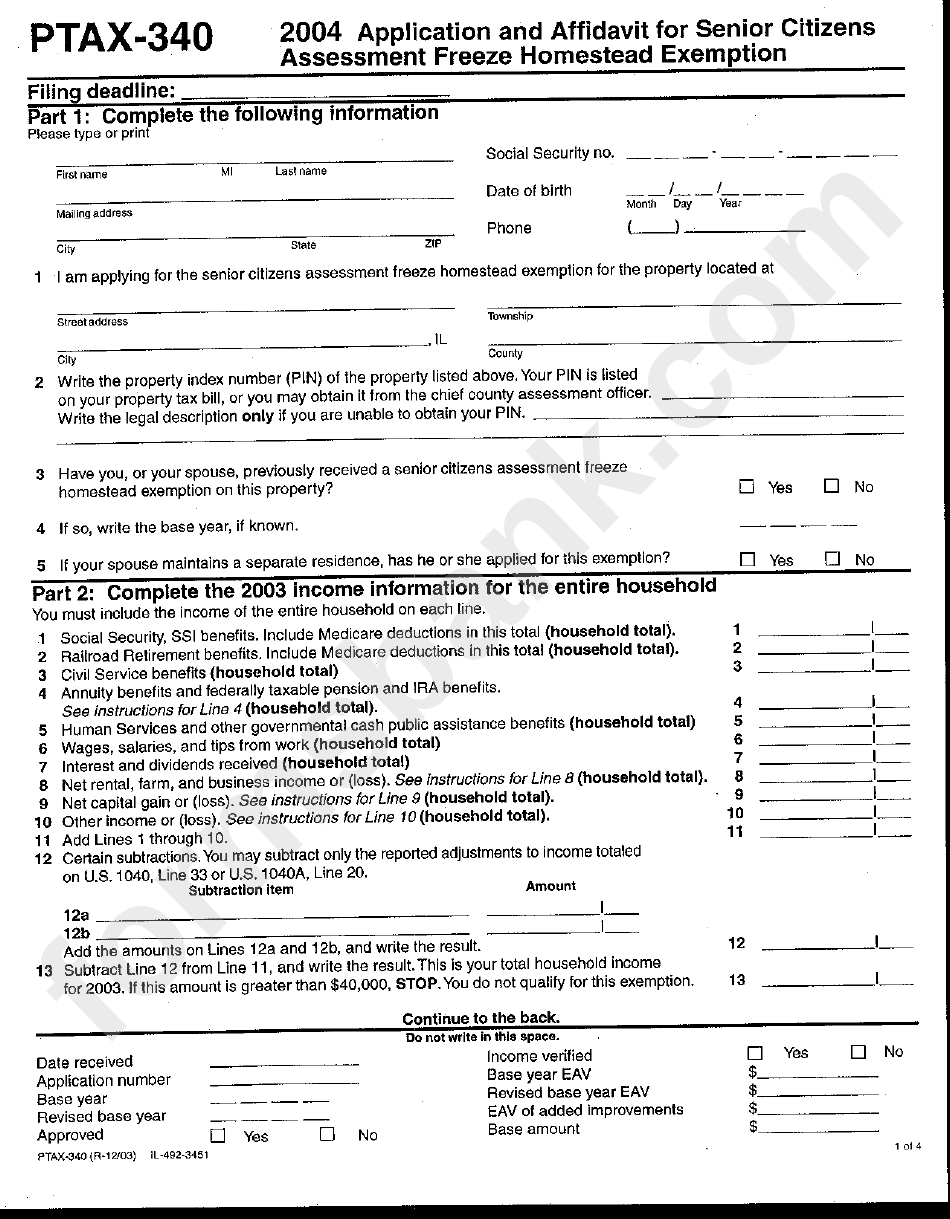

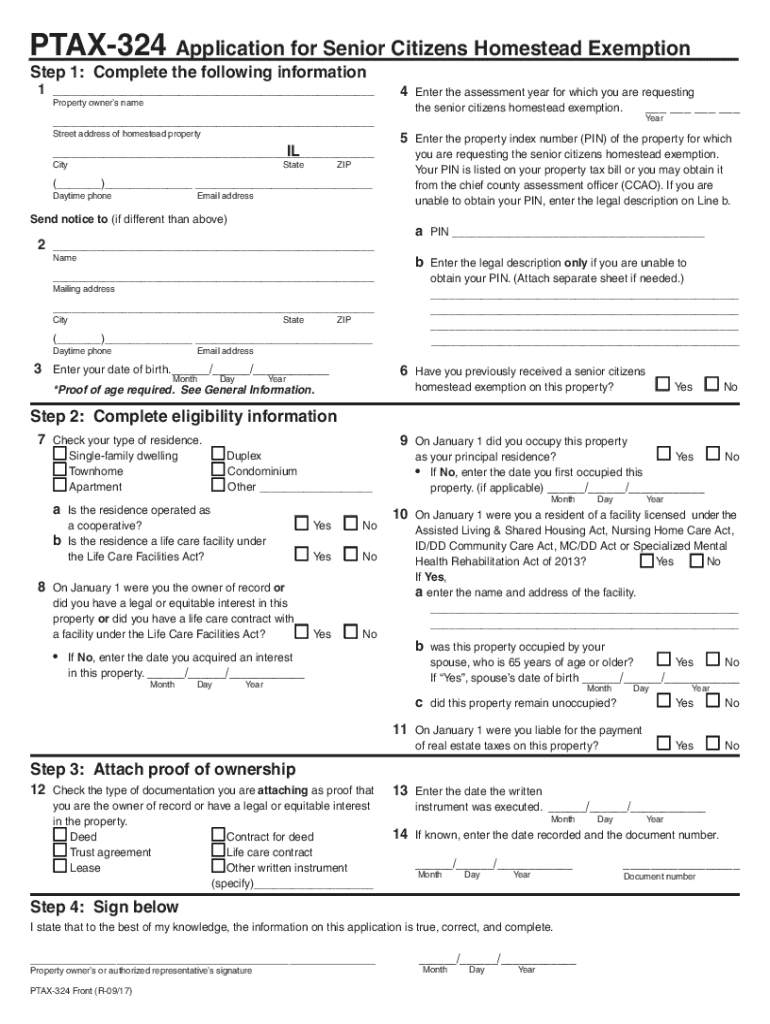

Form Ptax 340 Senior Citizens Assessment Freeze Homestead Exemption, Application for property valuation limitation and additional homestead exemption. There are two application forms for the senior property tax exemption.

2025 Senior Citizen Exemption Application Form Cook County, To apply for the senior freeze exemption, the applicant must: Senior homeowners must apply for the senior freeze exemption every year during the normal filing period in spring.

Senior Freeze Hazlet Township, NJ, The short form is for applicants who meet the basic eligibility. To qualify for the senior freeze for 2025, you must have:

Senior Citizen Assessment Freeze Exemption Cook County Form, A senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Those who are currently receiving the senior freeze exemption will automatically receive a renewal application form in the mail, typically between january and.

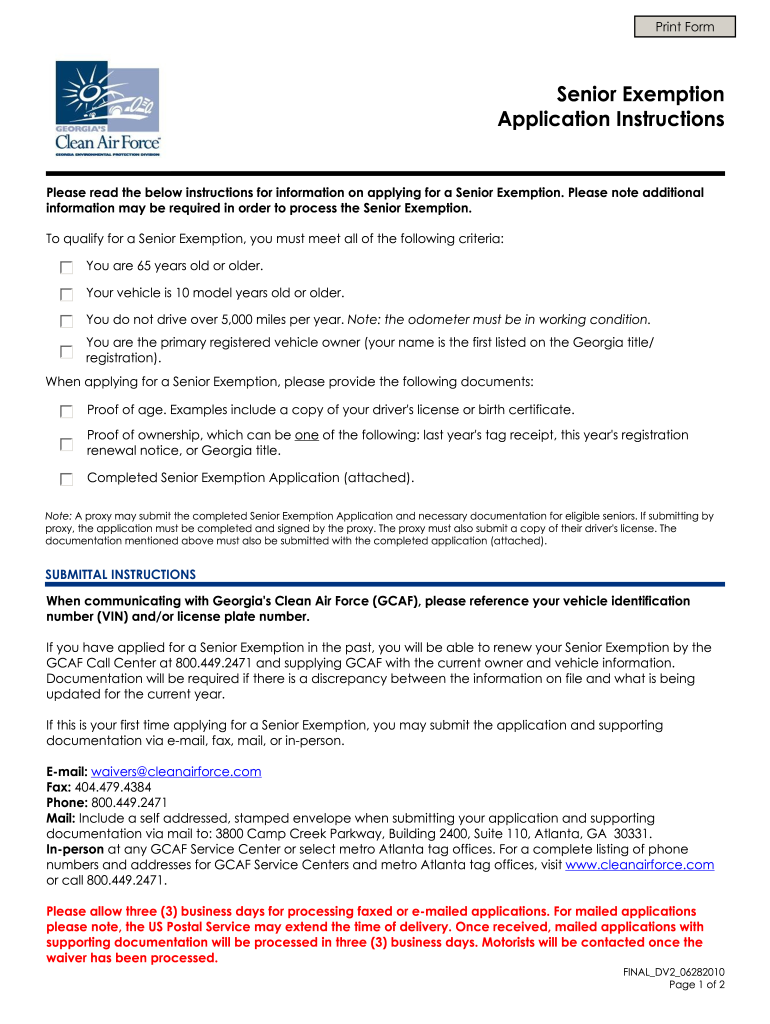

Clean air force senior exemption application Fill out & sign online, 6 the amount reported in part 3, line 13, of this form includes the income of my spouse and all persons living in. 2025 renewal application for senior citizen assessment freeze exemption this renewal is for households with an annual income below $65,000 enter parcel.

Ptax 324 20172024 Form Fill Out and Sign Printable PDF Template, Charles county, qualifying taxpayers must be at least 62 years of age on jan. Those who are currently receiving the senior freeze exemption will automatically receive a renewal application form in the mail, typically between january and.

New Tax Slab FY 202324, AY 202425 Old, New Regime, You must be 65 years or older prior to january 1 of the current year. • be 65 or older by december 31, 2025;

Will County Senior Tax Freeze Form, You can also apply online at the philadelphia tax center at: Other exemptions, like the “senior freeze” for elderly residents making under $65,000 each year, must be renewed every year.

Application deadline extended for Cook County senior property tax, Local governments and school districts in new york state can opt to grant a reduction on the amount. Senior homeowners must apply for the senior freeze exemption every year during the normal filing period in spring.